Our Services

Tax Planning and Strategy — U.S. & International

Effective tax planning is more than just filing paperwork. It’s about creating a roadmap to minimize your tax burden while staying compliant. Whether you’re a U.S.-based entrepreneur or earning income abroad, we design personalized strategies that consider your unique situation. From timing income and deductions to entity structuring and international tax rules, we help you keep more of what you earn and avoid surprises.

Tax Return Preparation and Compliance — U.S. & International

Preparing tax returns can be complex, especially with cross-border considerations. We handle everything from individual and business returns to more specialized filings for both U.S. and international tax obligations. Our process ensures accuracy and compliance with federal, state, and local requirements, giving you peace of mind that your taxes are done right every year. We prepare tax returns for:

- Individuals

- Sole proprietors and Single-member LLCs

- S corporations

- C corporations

- Partnerships and Multi-member LLCs

- Trusts

- U.S. expatriates and foreign nationals

- U.S. persons with foreign entities, investments, or income

- Foreign entities with U.S. filing obligations

Bookkeeping and CFO Advisory Services

Accurate bookkeeping is the foundation of sound financial decisions. We offer reliable monthly bookkeeping to keep your records clean and up to date. Additionally, our CFO advisory services provide deeper insights into your financial health, helping you interpret reports, manage cash flow, and plan for growth. Whether you’re a startup or a scaling business, we help you make smarter, data-driven decisions.

IRS and State Representation — Tax Controversy & Dispute Resolution

Facing an audit, tax notice, or dispute with the IRS or state tax authorities can be stressful. We step in as your advocate, managing communications and negotiations on your behalf. Our goal is to resolve issues efficiently while protecting your interests. Whether it’s penalty relief, installment agreements for tax debt, or audit defense, we guide you through the process with clarity and confidence.

Partner Firms

Raz Tax is proud to partner with ZLS Bookkeeping LLC.

ZLS provides expert bookkeeping, financial statement insights, and business management services tailored for entrepreneurs and growing companies. Their team helps clients maintain accurate records, understand their financial performance, and make informed decisions to drive sustainable growth.

David Zimmerman – Co-Owner & Bookkeeper

Daniel Zimmerman – Co-Owner & Bookkeeper

Who We Work With

Industries We Serve

• Fitness and Wellness

• Sports

• Medical and Dental

• Legal and Financial Services

• Real Estate

• Technology, AI and Engineering

• Entertainment, Arts and Design

• Content Creation and Digital Media

Core Specialties

• Gym Owners

• Health and Fitness Coaches

• Personal Trainers

• Bodybuilders

• Nutritionists and Wellness Professionals

• Fitness Influencers and Online Educators

• Sports Coaches and Athletes

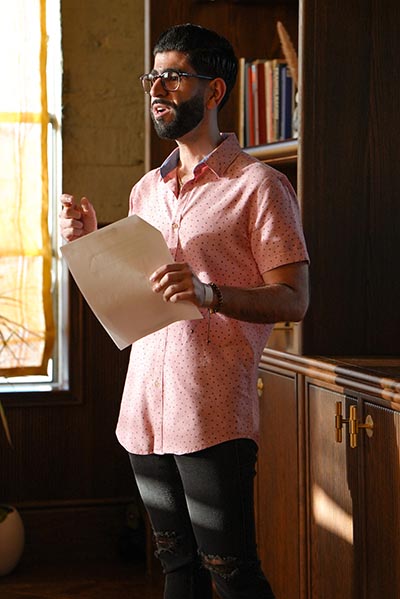

The Financial Fitness Podcast

Real conversations. Real strategy.

Your business questions don’t stop after tax season — and neither does the support.

Financial Fitness with Sam is the podcast where strategy meets real-world entrepreneurship. Through candid conversations with business owners, fitness professionals, and creators, Sam Razban-Nia, EA, breaks down what it takes to grow your business, stay financially sharp, and build something that lasts.